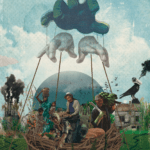

Turning their backs on the world

Feb 19th 2009

From The Economist print edition

The integration of the world economy is in retreat on almost every front

THE economic meltdown has popularised a new term: deglobalisation. Some critics of capitalism seem happy about it—like Walden Bello, a Philippine economist, who can perhaps claim to have coined the word with his book, “Deglobalisation, Ideas for a New World Economy”. Britain’s prime minister, Gordon Brown, is among those who fear the results will be bad.

But is globalisation really ending? The world’s economies are certainly slowing fast. And the speed and scale of this recession are raising doubts about the assumptions that had underpinned the drive to integrate world markets. At the end of 2008 the IMF said the world economy would grow 2.2% in 2009, less than half the rate in 2007. Now it thinks growth will be just 0.5% this year, the lowest for 60 years. Even that may be optimistic; in the last quarter of 2008, some economies shrank at annualised rates of over 10%.

Nobody ever said globalisation had ended economic ups and downs, but this feels different: prima facie evidence of big problems at least, and possibly of the failure of globalisation to deliver many of its advertised benefits, especially to the poor. True, economic slowdown is not the same as deglobalisation. And the slowdown has yet to affect one thing. For years, poor countries have been growing faster than rich ones; so far, they still are. The gap between real GDP growth in emerging markets and in rich countries widened from nothing in 1991 to about five points in 2007—and, says the IMF, it will stay at 5.3 points in 2008 and 2009. Helping poorer countries catch up has long been among the benefits touted for globalisation.

And yet the process is going into reverse. Globalisation means the global integration of the movement of goods, capital and jobs. Each of these processes is now in trouble. World trade has plunged. As recently as the first half of 2008, boosted by rising commodity prices and a falling dollar, trade was growing at an annualised 20% in dollar terms. In the second half of 2008, as commodities sagged and the dollar rose, growth slowed fast; by September, says the IMF, it was in reverse. In December, says the International Air Transport Association, air-cargo traffic (responsible for over a third of the value of the world’s traded goods) was down 23% on December 2007—almost double the fall in the year up to the end of September 2001, a result affected by the 9/11 terror attacks.

The downturn has been sharpest in countries that opened up most to world trade, especially East Asia’s tigers. Singapore’s exports are 186% of GDP; its economy shrank at an annualised rate of 17% in the last three months of 2008. Taiwan’s exports are over 60% of GDP; and its economy may fall as much as 11% this year. The downturn has also hurt rich countries that specialise in staid old-fashioned manufacturing—supposedly a safer activity than the reckless delusions of finance. On average, says the IMF, rich countries will contract 2% this year. But Germany and Japan, big exporters of capital goods, cars and electronics, will do worse, their economies shrinking by 2.5% and 2.6% respectively. In the last quarter their economies contracted alarmingly, falling at an annualised rate of 8% in Germany and by 13%—the worst since 1974—in Japan.

Small countries which went into businesses that grew in globalisation’s wake, like tourism, are also suffering. The World Tourism Organisation says international tourist arrivals fell 1% in the second half of 2008, which may not sound bad, but compares with growth of more than 5% a year for the previous four years. In the Caribbean, visitors may fall by a third this season; in some islands hotels are half empty, flights are being cancelled and national budgets, reliant on tourism, are strained.

In contrast, the biggest emerging markets are doing less badly so far. In India, where exports are around 15% of GDP, the government recently said growth in the year to April 2009 would be 7.1%; most forecasters put growth for the 2009 calendar year lower, but still about 5%. In Brazil the economy has been harder hit by falling commodity prices and declining exports. Most economists still think output grew a bit in the year to the fourth quarter, and put growth for 2009 at 1.5% to 2%. China was still growing by 6.8% in the year to the fourth quarter, though like Brazil it is probably stagnating. Chinese exports fell 18% and imports 43% in the year to January. All three countries have large domestic markets and relatively stable banking systems, which have not been liberalised.

The gap between toothless tigers and friskier BICs (ie, BRICs minus Russia, a special case because of oil) raises questions not so much about globalisation as a whole—after all, Brazil, India and China have been beneficiaries—as about particular aspects. Can one be too dependent on trade? How far should one liberalise banking? Is there a trade-off between taking advantage of good times and providing shock absorbers for bad ones?

Emerging markets’ trade problems have been worsened by shifts in capital flows, globalisation’s second big plank. According to the World Bank, net private debt and equity flows to developing countries will fall from $1 trillion in 2007 to $530 billion in 2009, or from 7.7% to 3% of those countries’ GDPs. The Institute for International Finance sees an even steeper fall; it says that this year banks will extract more from emerging markets in debt repayments than they inject in new loans. Bond markets in those countries collapsed in the last quarter of 2008, doing less than $5 billion of business; in the second quarter, they had issued about $50 billion of bonds.

As with trade, financial deglobalisation is hitting countries in a variety of ways. In this case, East Asia has been less affected because most countries there are net creditors. But eastern Europe and Russia have been hammered because local banks went on a foreign-borrowing binge, foreign banks piled into their markets (and piled out again) and because some countries lacked insurance policies against tough times. Although many big emerging markets have built up foreign-exchange reserves and cut their external debts, in eastern Europe reserves have been flat, external debts have risen and current- account deficits have grown considerably in the past decade. In these countries, the reversal of globalisation has exacerbated problems that were building up anyway.

People in emerging markets have mixed feelings about financial liberalisation and may not regret its reversal. But foreign direct investment (FDI) is different. Most people welcome new factories and new jobs. FDI is also one of the commonest routes by which skills and technology are transferred from rich to poor countries.

This, too, is falling. The United Nations Conference on Trade and Development (UNCTAD) says worldwide FDI inflows shrank 21% in 2008 to $1.4 trillion. The World Association of Investment Promotion Agencies says FDI will contract by a further 12-15% this year.

In contrast to trade, the investment impact of the global downturn has so far been hardest on the countries where the woes began: rich ones. They have seen FDI falls of one-third on average and by half or more in Britain, Italy and Germany. Finland and Ireland have seen net outflows. FDI flows to developing countries were still growing in 2008, albeit by only 4%, after a rise of 21% in 2007. Flows to big South American countries were up by about a fifth; those to India more than doubled, though they may ebb as GDP falters.

The third of the three main aspects of globalisation—jobs—is following the other two, with a lag. The International Labour Organisation forecasts that unemployment worldwide will rise by around 30m above 2007’s level in 2009. Most of that rise will be the result of recession, not deglobalisation, but some will be attributable to the fall in trade (exporting companies will lay off workers) and some to declining investment (if expansion plans are cut, new jobs will not be created).

Deglobalisation will have a dire impact on migrants. In the past decade, more people have been moving voluntarily than ever before; now, some are going home. Those who provided labour for the housing boom in America (notably Latinos), Ireland (Poles) and China (rural Chinese going to cities on the eastern seaboard) have been among the first to be laid off. In Spain newly jobless builders are competing with migrants there for jobs picking fruit.

This will surely have an effect on the flow of remittances from rich countries to poor ones, although it has so far (see article) been quite resilient. In any case, economies that absorbed large numbers of foreign workers may take fewer. Some of the millions of South Asians who work in the Gulf, or the young Africans who flock to South Africa, or the Central Asians who work in Russia, may have to stay at home.

Yet for all the economic pain, the social and political fallout from deglobalisation has not yet been severe. Protests may still come. Or maybe national governments are absorbing most of the ire. In December, Greece saw riots after a police bullet killed a teenager. In France, unions brought over 1m people onto the streets for a one-day strike, and a riot in Latvia over economic policy ended in more than 100 arrests. But only in Britain, where workers have picketed refineries and power stations over the hiring of foreigners, has protest had a very anti-global tone.

This lag may be explained by residual support for globalisation, especially in emerging markets. A poll in 2007 by the Pew Global Attitudes Project found that majorities in 47 countries saw international trade as good for them; majorities in 41 out of 46 welcomed multinational firms; in 39 out of 47, most felt better off with a free market. In more than half the countries where changes could be tracked, support for free markets was rising.

When consensus wobbles

But is that still true? Last summer, on the eve of the meltdown, European Union pollsters reported that two-thirds of EU citizens saw globalisation as profitable only for large firms, not citizens. In 2002, according to the Pew poll, 78% of Americans thought foreign trade helped the country; by 2007 it was only 59%. A CNN poll in July 2008 showed that, for the first time, a small majority of Americans saw trade as a threat, not an opportunity.

Of the few worldwide polls to have been completed since then, one by Edelman for the World Economic Forum found that 62% of respondents in 20 countries said they trusted companies less or a lot less now. Manifestly, popular opinion backs more state regulation.

So far, this has mostly taken the form of pouring public money into banks and selected industries, notably cars. Last week Barack Obama set out plans for another vast bank rescue, and the French government promised €6 billion ($7.8 billion) in preferential loans to Renault and Peugeot-Citroën in return for pledges that no car factories would be closed in France.

There has been somewhat less evidence of trade protectionism. India has raised some steel tariffs. The EU has reintroduced export subsidies for some dairy products. Russia has raised import duties on vehicles. But there has also been movement the other way. The American Senate softened the “Buy America” provisions of the stimulus bill. Mexico said that by 2012 it would cut tariffs on thousands of kinds of manufacture. And some countries have sought a safe harbour, rather than embracing pure nationalism. East Europeans are even keener on the shelter of the euro; Iceland has applied to the EU; the Irish are more likely than they were to vote for the EU’s Lisbon treaty.

Despite the downturn, the nations of the world have not shunned globalisation. It has been protected by the belief of firms in the efficiency of global supply chains. But like any chain, these are only as strong as their weakest link. A danger point will come if firms decide that this way of organising production has had its day.