The landscape of global investment governance is characterized by a web of international investment agreements (IIA) that seek to promote and protect investments and investor rights. UNCTAD reports that by the end of 2012, the IIA regime consisted of 3,196 agreements, which included 2,857 bilateral investment treaties (BITS) and 339 “other IIAs”, such as integration or cooperation agreements with an investment dimension.

While BITS still constitute the biggest share of new international agreements, there has been a steady decline of new BITS signed. For 2013, of the 30 IIAs concluded, only 20 were BITS. This number according to UNCTAD represents the lowest annual number of concluded treaties in a quarter century.

Trend of Foreign Direct Investment

The World Investment Report 2013 noted the following trends in global investment:

- The unravelling of Foreign Direct Investment (FDI ) recovery- compared to positive growth in other key economic indicators, global FDI fell by 18 % to the level of $1.35 trillion in 2012.

- Developing economies as surpass developed economies as recipients of FDI accounting for a record 52 per cent of global FDI inflows, exceeding flows to developed economies for the first time ever, by $142 billion.

- FDI flows to and from developed countries plummet FDI outflows from developed countries dropped by 23 percent to $909 billion – close to the trough of 2009. The uncertain economic outlook led transnational corporations (TNCs) in developed countries to maintain their wait and-see approach towards new investments or to divest foreign assets, rather than undertake major international expansion

- The number of State-owned TNCs increased from 650 in 2010 to 845 in 2012. Their FDI flows amounted to $145 billion, reaching almost 11 per cent of global FDI.

- International production of TNCs continued to expand at a steady rate. TNCs domiciled in developing and transition economies increased their foreign assets by 20 per cent, continuing the expansion of their international production networks.

- With increasing south – south FDI incomes, the challenge is how to channel retained earnings to productive investments.

The Three Policy Trends

In terms of policy trends, the report noted three main developments. The first, national protection, is the increasing emphasis at the national level on investments as a means for productive capacity building and sustainable development. UNCTAD noted the risk that some of the measures are undertaken for protectionist purposes. A second trend, regional investment, is the increasing preference for regional approach to investment agreements. The report notes as well the opportunity to address inconsistencies and overlaps, and address development dimension in new agreements as many of the existing BITS are already ripe for termination. Lastly, investment arbitration, the report weighs in on the on-going debate over investment arbitration by putting forward five broad areas of reform: (1) promoting alternative dispute resolution, (2) modifying the existing investor to state dispute settlement (ISDS) system through individual IIAs,(3) limiting investors’ access to ISDS, (4) introducing an appeals facility and (5) creating a standing international investment court.

ASEAN and the investment chapter in FTAs

An emerging trend in the international investment regime is the increasing use of free trade and economic partnership agreements as instruments for securing greater investor protection. In September 2011, the Council of Ministers of the European Union approved three identical negotiating mandates authorizing the European Commission to initiate talks on investment agreements as part of on-going negotiations for free trade agreements (FTA) with Canada, India and Singapore.

The EU-Singapore FTA, which has been referred to as a template for the rest of ASEAN, provides a good basis of the EU trade agenda in these bilateral talks.

In 2007, the EU launched the EU-ASEAN FTA negotiations anchored on a region to region approach, supposedly to address the development asymmetries that exist in the ASEAN region.

The regional approach however soon gave way to bilateral talks with select ASEAN member states due mainly to the perceived inability of ASEAN to rise up to the level of ambition in the talks that the EU had in mind when it agreed to launch the negotiations. In January 2010, EU’s bilateral track became operational with the launch of the EU-Singapore FTA negotiations. In October of that same year, EU launched talks with Malaysia. In June 2012, the talks with Vietnam were launched and in 2013 Thailand joined the list of countries within ASEAN engaged in bilateral negotiations with the EU.

Standards of Investor Protection: ISDS

The investor to state dispute settlement (ISDS) mechanism stands out as one of the most contentious issues in the international investments regime. Investor-state dispute settlement mechanism, which is embodied in most investment treaties provide rights to foreign investors to seek redress for damages arising out of alleged breaches by host governments of investment-related obligations (OECD). According to the United Nations Conference on Trade and Development (UNCTAD), there has been an enormous rise in the number of treaty based cases since the 1990’s. The increase in the number of cases is attributed to increases in investment flows, increases in international investment agreements, greater complexity of recent IIAs. The spread of news about large and successful claims is also seen as having spurred the rise in arbitration cases over the years.

Objectives

- To understand the elements of the international investments regime and in particular the nature and characteristics of the investor to state dispute settlement mechanism;

- To analyse ISDS and the challenges of this provision through a discussion of the existing cases/claims;

- To strategize on a possible course of action on ISDS in the context of the impending negotiations for EU FTAs in ASEAN

9.00 – 17.30, September, 2-3 2013

Asia Hotel Bangkok, BTS Ratchathewi Station

Day 1 (September 2nd, 2013)

|

|

Sessions

|

Speakers / Facilitators |

|

8.30 – 9.00 |

Registration

|

|

|

9.00 – 9.30 |

Opening / Introduction

|

Ph.D. Niyada Kietying-Angsulee Manager, Drug System Monitoring & Development Program |

|

9.30 – 11.00 |

Understanding the landscape of investment policy and development: Focus on BITs and ISDS

-International, regional and national historical and political economy perspectives

|

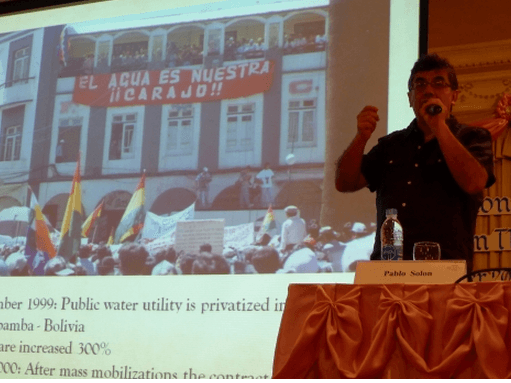

Pablo Solon, Focus on the Global South

Charles Santiago, Member of Parliament Malaysia

Dr.Buntoon Sethasiroj Good Governance for Social Development and the Environment Institute

|

|

11.00 – 11.15 |

Break |

|

|

11.15 – 12.45 |

Implications of investment agreements and ISDS: Case studies on Economy and Health - Economic crisis(Argentina) - Health (Canada) - Tobacco case (Australia) |

– Dr Javier Echaide, ATTAC Argentina

– Stuart Trew, Council of Canadians

-Kannikar Kijtiwetchakul, FTA Watch |

|

12.45 – 13.45 |

Lunch |

|

|

13.45-14.45 |

Implications of investment agreements and ISDS: Case studies on Environment - Environment (Germany and Indonesia) |

-Representative from Germany

-Institute for Global Justice (IGJ)

|

|

14.45 – 16.00JC |

Analysis of case studies and most problematic substantive -definitions of investment -fair and equitable treatment standard - indirect expropriation -national treatment -establishment -Most Favored Nation Treatment -compensation |

– Investment law expert |

|

16.00 – 16.15 |

Break |

|

|

16.15 – 17.00 |

Arbitration Systems, processes, and Governance |

-Cecilia Olivet, Transnational Institute

|

|

17.00 – 17.30 |

Synthesis and Summary |

FTA Watch |

Day 2 (September 3rd, 2013)

|

9.00 – 10.30 |

Emerging Trends on Reform and Alternatives:: |

Panel: Cecilia Olivet, TNI, Carl Middle ton, Chulalongkorn University, Pablo Solon, Focus on the Global South, a representative from FTA Watch, an investment law expert Moderated discussion |

|

10.30 – 10.45 |

break |

|

|

10.45 – 12.15 |

Strategies Sharing & Moving forward

|

Plenary discussion |

|

12.15 –12.45 |

Summary |

EU-ASEAN FTA Campaign network |

|

12.45 – 14.00 |

Lunch |

|

|

14.00 – 17.30 |

Regional network meeting |

EU-ASEAN FTA Campaign network |

![[IN PHOTOS] In Defense of Human Rights and Dignity Movement (iDEFEND) Mobilization on the fourth State of the Nation Address (SONA) of Ferdinand Marcos, Jr.](https://focusweb.org/wp-content/uploads/2025/07/1-150x150.jpg)