by Mary Ann Manahan

In the “green economy” (GE) water is treated as a natural capital, an economic asset which fundamentally puts a price on all the dimensions, services and functions of water. The GE proposes that the instruments of the markets are powerful tools for conserving water, improving water quality, ensuring efficiency of water use and protecting water itself.

The GE therefore goes beyond mere privatization and commodification of water as a public good and service. It sets the stage for the creation of markets where water and its ecosystem functions (e.g. water purification by pristine watersheds or carbon sequestration of forests and oceans) can be traded, while the people’s rights and common interests are ignored.

Specifically, the GE proposes to adopt and institutionalize water rights trading mechanisms, which have been pushed by the World Bank since 1996. Water rights trading, a property rights approach, is deemed as a ‘cornerstone of water management’, especially in solving water scarcity as well as encouraging private sector investments. In order to establish markets for water rights trading, the World Bank pushes for the separation of land and water rights through titling and permits.

The agriculture sector is being particularly eyed for water rights trading. Australia is, for instance, advancing water rights trading for food production and developing markets in water access rights. The proposal is not at all surprising. Australia has one of the most developed water rights system in the world. According to water broker Waterfind, temporary and permanent water rights trading across specialized exchanges in the country has totalled USD 1.3 billion in 2010 and is expected to grow at 20 percent a year.

However, this approach in practice has discriminated against small farmers and indigenous communities who depend on these resources for their livelihoods. Financially strong water users such as export-oriented agribusiness, landlords and corporations, municipalities and industries have dominated these water markets at the expense of low income population groups and traditionally marginalized communities and locals.

Water as the engine of the “green economy” also reinforces existing and emerging global futures market in water, which mirrors carbon emissions markets. Specialized water-targeted investment funds (exchange traded water funds, hedge funds, water certificates) are already being offered by major investment banks in the stock markets. Craig Donahue, the chief executive of the Chicago Mercantile Exchange, which is the world’s largest commodities trading exchange mentioned in a news report that the concept of a global futures market in water is not surprising; claiming that the “products are already being developed, derivatives exchanges are adapted to explosive growth and demands of China and India”. (1) Further, web portals such as Ecosystem Marketplace already offer investments trends on carbon, water and diversity markets with the belief that markets for ecosystem services are the best opportunities for corporate private sector and speculators to profit from the ecological crisis.

In Asia, commodifying water through the GE will not address the complex water problems in the region. For example, the melting of Himalayan glaciers, which is affecting some of the world’s greatest river systems and the water lifelines for 47 percent of the world’s population (China, India, Bangladesh, Nepal, Cambodia, Pakistan, Laos, Thailand and Vietnam and Myanmar), requires some form of regional cooperation and approach to share water rather than trading water rights across national boundaries.

In addition, the best practices or models of effective and efficient water management from Asia to advance the green economy are controversial and appalling. The UN-Water promotes Israel’s full cost water pricing scheme in managing demand in the cities and the agriculture sector of Israel. However, it is a well-known and documented fact that Israel is depriving Palestinians of water use and access through the closing of wells under the guise of water pricing to drive them off their lands. Another example of “best water management practice” to advance the green economy is the four major rivers restoration project in South Korea. The project has been heavily criticized by Korean civil society and those who were part of the project as it involved the construction of 16 dams along the four rivers, which contributed to the dwindling habitat of birds. The project was considered a “grand disaster” by civil society. If these are the models for Asia’s water woes, then they will likely create more problems than solutions.

Water is the lifeblood of the earth, the primary link between the climate system, human society, environment, food, energy, and economic development. But water as the engine of the “green economy” pays little attention to these hydrological inter-linkages. To allow water and nature to be controlled by the market undermines the opportunities of local people, communities and states to protect these commons as well as ensure equitable access to water and sanitation for all and to peacefully co-exist with nature.

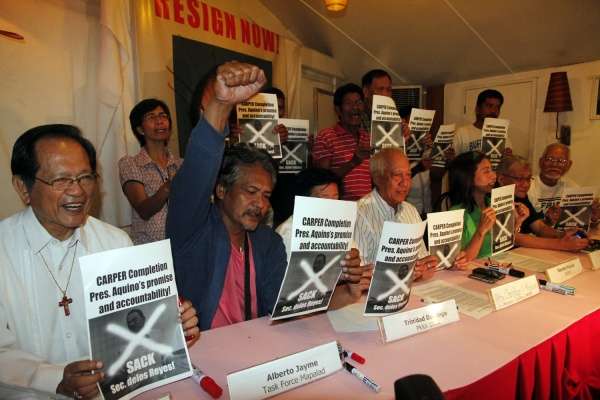

For the last decade, communities, local people and social movements from around the world have resisted water commodification and privatization, reflecting a collective desire to change the dominant flow of water policies and practice. The “green economy”, therefore, stands not only to reverse the gains achieved by social movements and communities; it also poses a grave threat to the future of water and ecosystems that rely on it.

But, on the upside, collective responses to stop the GE and put alternative visions and concrete proposals by social movements are already underway. At Rio+20 and beyond, it is, therefore, critical to remain steadfast and vigilant amid the real threat of commodifying water through the “green economy” and collectively rethink the dominant market-driven model of water management and governance.

Notes

1. Leo Lewis, Asia Business Correspondent, “Exchange chief hints at futures trades for water: Head of the world’s largest exchange says water could soon join oil and pork bellies as a tradeable commodity”, Times Online, October 18, 2007, Accessed on June 10, 2012.