Economic analysis often categorizes the economy into two distinct components: the “real economy” and the “financial economy”. The real economy is where production takes place, where value is created. Value is added by labor to the value of labor already embodied in the raw materials and machines used in the production process. The sectors where this new value or surplus value is created are preeminently in agriculture, industry, and services. Conversely, activity in the financial economy does not create much new value but artificially produces value from already created value. Another way of expressing this is “making money from money.”

Orthodox economic theory posits that the financial system is the mechanism by which the savers or those with surplus funds are joined with the entrepreneurs who have need of their funds to invest in production. However, in the context of late capitalism, the financial system is where money is invested into making more money, or value is squeezed out of already existing value, owing to declining profits that can be drawn from investment in the real economy — meaning from industry, agriculture, or services.

It should be noted that this perspective is derived from the Labor Theory of Value, which serves as the foundation of Marxist economics . Conversely, orthodox neoclassical economics asserts that value is not created during the production process, but rather, arises from the increased satisfaction or utility that individuals derive from consuming an additional unit of a commodity.

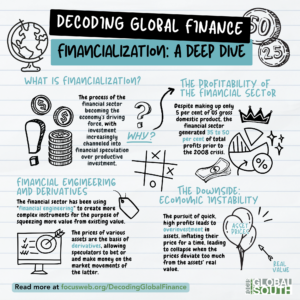

What is Financialization?

Financialization is a process that results in the financial sector becoming the driving force of the economy. It is characterized by a significant amount of investment being channeled into financial speculation instead of productive investment. This shift in investment priorities is driven by the higher profitability of investment in the financial sector. For example, prior to the 2008 financial crisis in the United States, the financial sector accounted for only 5% of the Gross Domestic Product (GDP) but generated 35-50% of total profits.

The financial sector has been using “financial engineering” to create more complex instruments for the purpose of squeezing more value from existing value. These instruments, collectively known as derivatives, are artificially derived from the movement of traditional assets such as stocks and bonds. The prices of various assets can be turned into derivatives, allowing speculators to make or lose money based on market movements.

However, this search for high and quick profits can result in systemic economic instability. Speculators drive up the prices of assets such as real estate, stocks, and derivatives beyond their actual value, leading to overinvestment and ultimately causing the collapse of asset prices when the divergence between prices and real values becomes too pronounced.

Stock Market Bull at Wall Street by Alankitassigments for Wikimedia Commons

Investment in in Production vs Investment in Finance

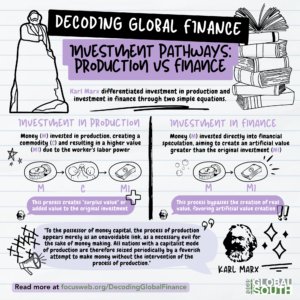

Karl Marx differentiated investment in production and investment in finance through two simple equations. In the first equation, M→C→M1, M represents money invested in the production process that results in the creation of a commodity (C) with a value (M1) greater than the original investment, owing to the labor power of the worker embodied in the commodity. This is the process of capitalist production that creates “surplus value” or value added to the original investment. In the second equation, M→M1, the capitalist’s money is invested directly in speculation in already created value, with the aim of creating an artificial value greater than the original investment (M1).

Marx argues that finance capitalists would prefer the second, speculative route of expanding their wealth, rather than having to invest in the production process and adding real value to their investment.

“To the possessor of money capital, the process of production appears merely as an unavoidable link, as a necessary evil for the sake of money making. All nations with a capitalist mode of production are therefore seized periodically by a feverish attempt to make money without the intervention of the process of production.”

From Regulation to Deregulation

The Great Depression that began in 1929 was a result of a feverish attempt to make money without production, with banks and bankers at the forefront of the speculation that brought down the real economy. In response, governments tightened regulation of financial institutions, separating investment banking from commercial or retail banking via the Glass-Steagall Act and imposing tight controls on cross-border flows of capital to prevent speculative crises from spreading internationally.

However, the neoliberal revolution of the late 1970s and 1980s led to the abolition or loosening of government controls on finance. The Clinton administration repealed the Glass-Steagall Act, allowing for the reunification of retail and investment banking, giving banks access to people’s deposits for speculation. The Reagan administration in the United States and the Thatcher government in the UK lifted restrictions on cross-border flows of capital, allowing capital to seek the highest return on investment.

With capital moving freely from one market to another and advancements in information technology, speculative mania was communicated quickly, leading to numerous financial crises. From 1940 to 1980, there were hardly any international financial crises, however, since 1980, there have been some 15 major financial crises including the Third World Debt Crisis in the early 1980’s, the Japanese Financial Crisis in the late eighties, the Asian Financial Crisis of 1997-1998, the Russian Financial Crisis of 1998, the dot.com bust in the early 2000’s, and the 2008-2009 Global Financial Crisis.

Types of Financial Crisis

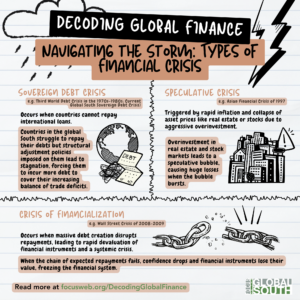

Sovereign Debt Crisis

The sovereign debt crisis is a financial crisis faced mainly by countries in the global South, where they struggle to repay their loans from international banks One of the most significant cases of this occurred in the late 1970s and early 1980s, known as the Third World Debt Crisis. Lately, another sovereign debt crisis, exhibiting the same features as the earlier crisis, threatens to again engulf the global South.

During the lead-up to the first crisis, dictatorships went on a borrowing spree and spent much of the borrowed money on weapons, useless monuments, and corrupt deals. This is, however, is only part of the story; the other half was that western banks tried their best to hook third world debtors in order to make money from the deposits made by the Organization of the Petroleum Exporting Countries (OPEC) that raised the price of oil in the 1970’s. So the debt crisis was a joint creation by western banks, on the supply side, and dictatorships like the Marcos regime and the Suharto regime on the demand side.

The bankrupt governments went to the International Monetary Fund (IMF) and the World Bank for loans to pay off their creditors. What came to be termed structural adjustment loans were given by the IMF and the World Bank, but only on condition that the recipient governments undertook “reforms” that promoted privatization, liberalization, and deregulation. It took many years for successor governments to the dictatorships to pay off the billions of dollars the latter had incurred from the international banks, and they, in fact, saw their debt situation worsen since they now also incurred loans from the IMF and the World Bank to pay off the private creditors.

Indeed, several decades later, many countries were still paying off their debts from the first crisis when they were engulfed by the latest debt crisis.

A number of defaults on debt repayments over the last three years have served as the alarm bells for a possibly even bigger implosion than the first sovereign debt crisis. Carrying a debt load of $324 billion that came to 90 per cent of its gross domestic product, Argentina defaulted on a scheduled payment in May 2020. Zambia followed suit in November 2020, missing a $42.5 million payment on a Eurobond loan. It was followed by defaults by Sri Lanka, Surinam, and Lebanon. it was Sri Lanka’s default in April 2022 that drew the attention of the word to the potential explosiveness of the emerging debt crisis in the global South, perhaps owing to the downfall of a political dynasty, the Rajapaksa family, amidst blackouts, long queues for food and other basic commodities, and massive street protests.

A striking similarity is how in both the 1970’s and the last few years, a period of easy money or reckless lending was followed by the reign of tight money as the United States’ Federal Reserve sought to combat inflation by raising interest rates, leading to the formal or informal default of countries ensnared with insupportably greater debt repayments.

There is, however, a thread of continuity between that earlier crisis and the present one: the indebted countries never really got out of the debt trap not only because their ratios of debt to GDP remained high but also because the structural adjustment programs they were forced to submit to to get a modicum of debt relief for the first crisis weakened their economies and made them vulnerable when the second crisis unfolded.

The Philippines, which was one of the countries included in the Brady bonds scheme, is a case in point. Structural adjustment, one of the conditions for eligibility in the program, had a depressive effect on Philippine growth, with the economy growing at a minuscule 1.5 per cent per annum between 1990 and 2010, the second lowest growth rate in Southeast Asia. Trade liberalization resulted in the destruction of the country’s manufacturing base and massive import penetration in all key agricultural commodities. The country’s trade deficit mounted and to cover it, the country’s borrowings escalated. Thus, the country’s debt burden grew from $26 billion in 1986 to $113 billion by the end of 2022.

Despite advance warnings, there is no plan in place to avert the impending implosion. The so-called Common Framework devised by the G 20, the World Bank, and the IMF is grossly inadequate. Instead, the western financial powers have indulged in a blame game, that is, identifying China as the problem. This charge has little basis since the record shows that China has, in fact, been quite generous in forgiving the debt of poor countries, especially in Africa. The real agenda of the “Blame China” lobby is to corral China into a common front that would impose stringent conditionalities on the indebted countries as the price for debt relief, an approach that China has rightfully pointed out has not worked because it does not address the structural roots of the developing country debt problem.

Creator: wildpixel | Credit: Getty Images/iStockphoto

Speculative Crisis

A speculative crisis is created by overheating of the real estate and stock markets owing to overinvestment by greedy investors seeking to profit from the growing divergence between stock or real estate prices and the real value of these assets. With the divergence growing so fast, everyone expects a crash. The point is to get out before prices collapse. Those who get out before the collapse make a killing. Those who don’t often lose their shirts because prices collapse faster than lighting, leaving them with nothing. Foreign investors are very vulnerable when speculative crises occur since their investments are made in local currency and must be changed into dollars in order to exit the country. But when everyone is rushing to get the dollars, the government quickly runs out of dollar reserves and one is stuck with local currency that has lost its previous value relative to the dollar.

This is what happened during the Asian Financial Crisis of 1997, of which Bangkok was the epicenter.

A bit of background. The so-called “Asian tiger economies” had relied on Japanese direct investment to fuel their economies in the 1980’s. But in the early 1990’s, however, Japanese investment was tapering off, and technocrats in these economies sought alternative sources of capital. They found these in western and Japanese banks and speculative investors who were raring to get a piece of the “Asian miracle,” as they put it. To come in, however, they wanted no entry and exit controls and demanded a fixed exchange rate between the local currencies and the dollar to assure them their investments would not depreciate. Encouraged by the International Monetary Fund, the ASEAN governments complied, resulting in the entry into the major economies of some $100 billion in portfolio investment between 1994 and 1997. The investment did not go to agriculture or industry but to real estate and the stock market since the latter promised quick and high returns.

Back to our narrative, foreign investors in the collapsing Thai real estate market were desperate to change their baht for dollars, but with the Thai government running out of dollar reserves to support the 1$:Baht 25 rate, the exchange rate fell to 1$:Baht 50, saddling the investors with massive losses. Foreign investors were also heavily exposed in the property sector in Malaysia, Indonesia, and the Philippines, and when they saw what was happening in Thailand, they also rushed for the exits, that is, exchange their pesos, ringgit, or rupiah. Like the Thai government, the Philippine and Indonesian government also ran out of dollar reserves to support the fixed exchange rate, so the local currencies were also devalued drastically, resulting in massive losses for foreign investors, as in Thailand. Malaysia followed a different path. It imposed exit controls, requiring foreign investors to hold the currency at least a year after the sale of Malaysian securities or assets in the country. This policy was widely viewed as a major contributing factor to its subsequent economic recovery.

As is the case with all financial crises, the Asian Financial Crisis was followed by recession in the real economy. There was, however, one positive result of the Asian Financial Crisis. This was the collapse of the Suharto dictatorship owing to its failure to halt the crisis and Suharto’s being blamed and reviled for acceding to the demands of the IMF. Below is the photo of IMF Managing Director Michel Camdessus standing over Suharto as he signed the IMF agreement. This photo helped bring down Suharto, which underlines the truth in the saying that a picture is worth a thousand words.

Michel Camdessus, head of the IMF, looks on as Indonesian President Suharto signs an agreement in Jakarta (1998). ASSOCIATED PRESS

Crisis of Financialization

A crisis of financialization occurs when banks, corporations, and individuals are engaged in the extension and creation of so much debt that a critical failure in the chain of expected repayments causes a loss of confidence that is so contagious that the instruments of debt rapidly lose their value, bringing the financial system to a halt. This is the financial equivalent of a cardiac arrest.

This is what happened during the Wall Street Crisis of 2008-2009, also known as the Global Financial Crisis. The culprit was the so-called Subprime Mortgage.

A bit of background. Mortgages or housing loans are usually in the hands of the issuing lending bank until they are fully paid by the mortgage holder. However, owing to the miracle of “financial engineering,” mortgages were “securitized” so that they could be traded in the market. So whereas previously the originating bank had to make sure a borrower could pay over the lifetime of the mortgage, with securitization they could simply sell the mortgage to other financial institutions and forget it. The problem was that once the borrowers could not service the debt, these securitized mortgages (called “subprime” because they were made to “non-creditworthy” borrowers) became impaired in their value, so that whoever had bought them (because they seemed a great investment since their prices were rising before the problem of not being serviced became known) and was foolish to hold on to them lost a great deal of their investment. Some five trillion dollars’ worth of subprime mortgages simply went up in smoke.

Continuing our narrative, the investment bank Lehman Brothers was stuck with so many securitized mortgages that were no longer serviced by debtors, many of whom simply walked away from their homes. When knowledge that its balance sheet had become impaired, it could not raise money on capital markets to cover its losses and it fell into bankruptcy — this created a big scare.

Other big financial institutions like Citigroup were also loaded with subprime assets and other impaired derivatives and if they all failed to cover their losses with loans from other banks, the whole system would collapse. Hence, the George W Bush Jr. administration got the US Congress to cough up $787 billion to save the big banks and save the system. Eventually, the government had to spend up to $2.2 trillion to bail out the banks. As for the millions of people who lost their homes because they could not service their mortgages, they got no support from the government.

Lehman’s Collapse, on the Front Page – In September 2008, unprecedented crisis gripped the world markets after Lehman Brothers folded. WALL STREET JOURNAL

As with all financial crises, the so-called Great Recession followed on the heels of the Global Financial Crisis. Why? Because so much money that could have been invested in productive activity was lost in the financial collapse, because so many people lost their life-savings and their jobs, because so many people who had contracted so much debt from various sources, since they had been led to believe the speculative boom would go on forever, were bankrupted. All these contributed to a collapse in demand and, combined with the freezing of much lending in the financial sector owing to widespread bankruptcies, they brought the whole real economy to a halt. The US had not really recovered from the 2008 financial crisis by the time Covid 19 came around in 2020. Of course, there were other causes of the prolonged US economic crisis, like deindustrialization, but the legacy of the Wall Street Crisis was one of its key causes.

Key Institutions of Global Finance

Banks

Banks used to be classified into commercial or retail banks that took money from depositors and lent them to creditors who needed the money for consumption or investment, and investment banks that specialized in identifying and directly financing investment ventures. These two types of banks were legally separated during the Great Depression to prevent retail banks from recklessly investing their depositors’ money in speculative ventures that were prone to crash, bankrupting both banks and depositors.

As noted above, the repeal of the Glass Steagall Act during the Clinton administration allowed financial institutions to undertake both taking deposits from people and directly investing these in speculative ventures. The new “multipurpose” or “universal banks’ reckless investment in dubious securitized instruments like the subprime mortgage loans created by financial engineering was one of the causes of the Wall Street Crisis of 2008.

In a capitalist economy, it is the banks that create money when they make loans since they invariably lend out much more money in the form of debt than the money that is deposited in them as savings.

Central Banks

The Central Bank, known in the US as the Federal Reserve, is an autonomous government institution that serves as the main regulator of the financial system. The Federal Reserve (the Fed) indirectly determines the prime lending rate or the interest rate used by banks in their lending to businesses. Through its control of the prime rate, the Fed can greatly influence the level of economic activity. When the prices are rising too fast and too high, the Fed can cool down the economy by raising the prime rate. When economic growth is slowing down, the Fed can lower the prime rate, encouraging firms to borrow to make investments, thus spurring economic growth and creating more jobs. That’s the way it’s supposed to work, but there have been times when this manipulation of the interest rate has not worked, such as in the aftermath of the 2008 financial crisis, when bringing down the interest rate to zero failed to revive the economy, or today, when continuously raising the interest rate has failed to dampen inflationary pressures.

The Central Bank also controls the money supply or supply of paper bills and coins, depending on its calculation of how much new money has been created by banks in their lending activities.

International Monetary Fund

The International Monetary Fund (IMF) is part of the multilateral system of economic institutions at the global level that promotes mainly the interests of global capital, especially US capital. For our purposes in this section, the IMF has been one of the key institutions involved in stabilizing economies that are mired in financial crises. In recent financial crises, the IMF has made emergency loans to countries in crisis, but this has been in return for their governments’ committing themselves to the standard IMF formula for stabilization, which is to radically cut government expenditures and undertake “structural reforms,” that is to push privatization, trade liberalization, and deregulation, a triad that has come to be known as “structural adjustment.”

Taking IMF intervention in the Asian Financial Crisis, two things must be noted. The diagnosis of the problem was that it was caused by inflation, whereas the real trigger was a collapse in demand in the real economy following the collapse of the financial sector. So its formula of cutting government expenditure had the effect of accelerating (or providing a “cyclical” push) instead of countering (“countercyclical” push) the collapse of the private sector. Most of the IMF loans ($4 billion to Thailand, $21 billion to Korea, and $10 billion to Indonesia) went to foreign private investors to cover their losses, with the governments simply serving as an intermediary. Little was spent as investment to restart economic growth. The IMF loans added to the debt burden of countries in crisis. This was a heavy added burden because agreements with the IMF are made with the explicit understanding that unlike private sector loans, repayments to the IMF cannot be rescheduled, reduced, or forgiven.

During the 2008-2009 global financial crisis, the IMF expanded its jurisdiction to developed countries in crisis, assisting the European Commission and European Central Bank in imposing structural adjustment on Greece, Portugal, Ireland, and a number of Eastern European economies. Not surprisingly, as in Asia during the Asian Financial Crisis, the crisis of the real economy in these countries worsened and recovery came quite late.

Given the huge burden imposed by IMF programs on developing countries, some governments that had IMF programs promised never to go back to the Fund for help. In 2003, upon Thailand’s fully repaying the emergency IMF loan it contracted in 1997, the government of Thaksin Shinawatra declared “independence from the IMF” and promised never to get another loan from the Fund. In 2007, the government of Lula in Brazil declared it would fully repay the IMF and never go back. This was followed by Nestor Kirchner’s government in Argentina fully paying off the Fund, with financial assistance from Hugo Chavez of Venezuela, and also promising never to again contract loans from the IMF.

Demonstrators march towards the obelisk during a protest against the government’s negotiations with the International Monetary Fund (IMF) over economic measures taken by Argentine President Mauricio Macri’s government in Buenos Aires, Argentina, May 25, 2018. REUTERS

The Dollar

The dollar is the world’s prime reserve currency—that is, for practically all global trade, it is the means of exchange. Some trading arrangements among countries are also denominated and carried in euros, some in yen, some in renminbi, some in sterling, but the coverage of such arrangements is very limited compared to the universal coverage of the dollar.

The dollar’s status as the world’s global reserve currency was established at the Bretton Woods Conference, held a few months before the end of the Second World War in July 1944—the same meeting that saw the founding of the World Bank and the International Monetary Fund. It reflected the global economic power of the United States compared to that of other capitalist countries like Britain, France, and Germany, which either found themselves in great debt owing to wartime loans from the US (Britain) or devastated during World War II (France and Germany).

The dollar’s value was fixed to that of gold, which is the reason the global monetary system was called the gold-dollar system. The rate at which the dollar was fixed to gold was at $1 to 35 ounces of gold. During the two and half decades after the war, so many dollars circulated as a result of growing global trade that many countries built up dollar reserves that dwarfed the gold stored by the US at Fort Knox. If all these countries cashed in their dollars for gold, it became clear that the United States would not be able to supply them with the necessary amount of gold. It was this growing discrepancy between the vast amount of dollars accumulated by other countries and the US’s gold reserves that led to the Nixon administration’s momentous decision to unilaterally delink the US from gold in 1971—that is, other countries could no longer exchange their dollars for gold at the 1 dollar: 35 ounces of gold exchange.

The global monetary arrangement that succeeded the gold-dollar standard saw the value of the dollar vis a vis the local currency determined both by global market forces and strategic intervention by governments—that is, governments intervened by setting bands within which their currencies “floating” against the dollar owing to market forces was allowed, but above or below the limits of which would bring about government intervention to either revalue or devalue the local currency (e.g., it could be devalued below the market rate if a government was desperate to earn more dollars by cheapening its exports in dollar terms). However, this new regime of floating currencies did not displace the role of the dollar as the universal reserve currency.

This dominant role of the dollar is termed seigniorage. It gives the US tremendous economic power over other countries because while they have to earn the dollars via their exports in order to engage in international trade, the US merely needs to print dollars to cover its trade deficit, relieving it of the pressure to increase its export of goods and services to balance its trade account. A former French president called this the dollar’s “exorbitant privilege.”

But while there have been criticisms of the dollar’s hegemonic role and many proposals to diversify currencies that can be used for international trade and capital movements, there has been no serious effort to implement them. Not even the Chinese government has dared to move towards a more diversified system, mainly because it holds billions of dollars in reserve owing to its exports to the US and other markets so that any move to challenge the dollar’s dominance could bring down the value of the dollar and thus of its own dollar holdings.

Whenever there is an international economic crisis, there is a tendency of corporations, governments, and individuals to change some of their investments or holdings in local currencies into dollars—a phenomenon called “flight to safety.” For instance, the current global inflation has resulted in so much flight to the dollar, resulting almost universally in local currencies losing value relative to the dollar. This “strong dollar,” because it results in more expensive imports in dollar terms, is a powerful force for recession throughout the world.

John Connally, a former US Treasury Secretary, once told foreign visitors, “The dollar is our currency and your problem.” This is as true today as when he said it over fifty years ago.

- #1 The Real Economy vs the Financial Economy: A Capitalist Dilemma

- #2 Financialization: A Deep Dive

- #3 Investment Pathways: Production vs Finance

- #4 The Shift: Regulation to Deregulation

- #5 Navigating the Storm: Types of Financial Crisis

- #6 Pillars of Power: Key Institutions of Global Finance