By Joseph Purugganan

Chaos has been the brand of the Duterte presidency. His governance has been characterized as “instinctive, abrupt, and with a penchant for the dramatic,”[1] and his leadership style as “one based on the methodical use of the coercive power of the state in order to intimidate dissenters, critics, skeptics, deviants, and non-cooperative individuals who, in his perception, are not taking him seriously.”[2]

Perhaps one aspect of his presidency that has been more thought-out, less chaotic, more consistent, and somewhat insulated from public scrutiny is his economic policy. In the 2017 Focus Policy Review (FPR), Focus dissected the so-called Dutertenomics and found that at its core lies the same neoliberal, pro-corporate agenda that has underpinned economic policies since Marcos.

Economic development under Duterte stands on twin pillars: TRAIN (Tax Reform for Acceleration and Inclusion)—the comprehensive tax reform program, and Build, Build, Build (BBB)—the infrastructure plan, which combined are envisioned to “raise per-capita income to the level of high-middle income economies by 2022.”[3]

Build, Build, Build is the government’s centerpiece economic program. As discussed in the 2017 FPR, BBB will be financed mainly through official development assistance from countries such as China, Korea, and Japan, and from the public coffers.

Because the BBB program is partly reliant on public financing, the full implementation of TRAIN is crucial. For the first five years of implementation, the TRAIN law earmarks “not more than 70% of the yearly incremental revenues generated to fund infrastructure projects such as but not limited to the BBB program.”[4] Based on the government’s 2019 projected revenues of around ₱181.4-billion from the tax reform program, as much as ₱126.8-billion could be earmarked for the infrastructure program.[5]

Rising inflation in 2018 thus posed a big challenge for the country’s economic managers. They had to move swiftly to stabilize commodity prices and tame inflation, while pressing on with the economic program—particularly on tax reform—amidst growing public unease.

Inflation Crisis

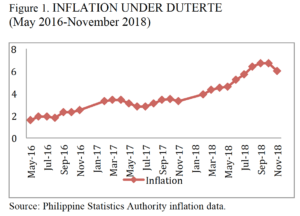

When Duterte assumed the presidency in May 2016, the national annual headline inflation rate stood at 1.6%. Since then the rates have steadily risen, albeit with slight declines during the second quarter of 2017. In March 2018, the rates breached the upper end of the government’s inflation target when the rates hit 4.3%. Since July 2017, the rates have consistently exceeded the 3% target, and began an upswing that would eventually peak at 6.7% in September and October 2018, the highest in over nine years.

Growing Public Discontent

Controlling inflation became one of the most important issues for Filipinos in 2018. The September 2018 nationwide survey of urgent national concerns conducted by Pulse Asia showed that a sizeable majority of Filipinos (63%) considered inflation an issue that must be immediately addressed by the Duterte government.[6] The report further noted that this was the “predominant opinion shared across all geographic areas and socio-economic classes.”[7]

Inflation was an economic issue that put the Duterte administration on the defensive. The same Pulse Asia survey showed a high 51% percent disapproval rate of the government’s performance in addressing the issue. But more than public disapproval of its handling of inflation, what was at stake was public support for the TRAIN program, which could then jeopardize the government’s revenue program and all other programs dependent on it, like the BBB.

In the midst of rising prices, TRAIN became the subject of widespread public criticism for its inflationary impacts. As early as May 2018, three senators led the calls for the suspension of TRAIN, in particular the provision on excise taxes on fuel, due to the soaring prices of commodities, especially food and fuel prices. The planned increase in 2019 would have increased the total excise tax on gasoline from ₱7 to ₱9 per liter, and on diesel from ₱2.50 to ₱4.50 per liter.[8] The move to suspend TRAIN was supported across the board by transport and consumer groups as well as progressive political blocs.

However, defenders of the tax reform program were quick to point out that suspending the implementation of the excise tax on fuels could cost the government around ₱26-41-billion in foregone revenues in 2019 alone.”[9] The Department of Finance estimates that excise tax on fuel would generate total revenues of around ₱564.8-billion over five years.[10]

Aside from additional revenues, a key policy question regarding the additional taxes is who will carry the greater burden from higher fuel prices brought about by the increase in fuel levies. According to Dr. Dennis Mapa, Dean of the School of Statistics of UP Diliman, poor households would feel the greater burden of the increased cost of diesel. Dr. Mapa estimates that with a ₱6 per liter tax on diesel, the effect on the inflation rate of the poor becomes ten times more than the effect on the inflation rate of the non-poor (1.794 percentage points and 0.180 percentage points respectively).[11]

Missing the Mark

The spike in inflation seems to have caught the government off-guard. In December 2017, the Bangko Sentral ng Pilipinas (BSP) issued its advisory on the government’s inflation target for 2018 whereby the inflation target was pegged at 3.0 percent ± 1.0 percentage point for 2018 – 2020.

Even when the rates had already breached the lower limit of its own target and registered more than a 100% increase since Duterte assumed office, the BSP continued to express confidence that the problem was manageable and that “inflation could settle within the current inflation target.”

The BSP nevertheless recognized “upside risks to the inflation outlook.”[12] These risks are brought about by “higher and volatile global oil prices, weakening peso, effects of the implementation of the TRAIN law on prices of domestic goods, and rising global inflation among others.”

Main Drivers

The economic managers took a more defensive position. The main drivers of inflation were identified as higher food prices (rice, corn, fish), tobacco, and personal transport prices—the latter largely driven by rising world crude oil prices.[13]

Food prices indeed rose steadily in 2018 reaching a peak 9.7 % year-on-year increase in September 2018. Supply disruptions and damage to agriculture, facilities, and infrastructure caused by the onslaught of Typhoon Ompong (also known as Typhoon Mangkut) in September 2018 were pinpointed as the main causes of the rice price hike.[14]

Aside from the climate-related problems, the decline in production can also be attributed to shrinking rice lands. Palay production dropped slightly in 2018 by a little over half a percent, as production declined by around 104,000 metric tons (MT) compared to 2017 output, reaching a total of 19.17 million metric tons. The harvest-area for palay, for both irrigated and rain-fed lands, showed net contraction of 10,000 hectares. There was also a slight decline of around 0.34% in productivity as yield per hectare declined from 4.01 MT per hectare to 3.99 MT per hectare.[15]

Substantial declines in production were also noted in the regions identified by government as having been hit hardest by Typhoon Ompong: Cordillera, Ilocos Region and Cagayan Valley. Altogether, output in these regions dropped by over 450,000 MT.

What the economic managers failed to address, however, is that the harvest area for rice in these three regions alone shrunk by as much as 34,618 hectares in 2018. Based on estimated yield per hectare in these regions, this contraction of harvest area amounts to a loss of close to 198,000 metric tons of palay.

Improving rice production to ease supply gaps, and the long term goal of making the rice sector more competitive, all gave way to importation as the means to lower rice prices. As pointed out by Omi Royandoyan of Centro Saka, “the solution, according to our economic managers, is to flood the local market with cheap imported rice.” Royandoyan countered that the country’s level of rice production is sufficient. According to data compiled by the Rice Watch Action Network, rice production on milled rice equivalent is 12,529,625.31 metric tons, short only of 129,610.29 metric tons to fill in the rice production gap with the rice/food requirement estimated at around 12,659,235.60 MT.

“If we include the NFA’s (National Food Authority) imported 243,992 metric tons of rice and government’s obligation with the minimum access volume that allowed the private sector imports of 600,000 metric tons, the total rice supply of 2017 is at 14,011,257.61—comfortable enough to supply the country’s rice supply requirement,” Royandoyan added.[16]

‘Swift and Decisive’ Response

The response from the government to inflation had both a defensive and offensive element to it.

Defend TRAIN

The government was quick to downplay the effects of TRAIN, particular the effect of excise tax on petroleum, sweetened beverages, and tobacco, saying the effect remains minimal at 0.4 percentage points, the same as in April 2018. This amounts to 9 centavos for every additional peso due to inflation.

Succumbing to strong public clamor, the Duterte government was forced to suspend the second round of implementation of the excise taxes on fuel under the TRAIN law in October 2018.

But by December, Duterte had already done a U-turn and gave the go-ahead for the implementation of the second tranche of excise tax on fuel, effective January 2019.”[17] Government cited the following reasons for the decision to push through with the additional fuel taxes: the downward impact on inflation owing to the steep drop in the Dubai crude oil price, the disruption in the infrastructure program, and reduction in budgets, including personnel services of national government agencies—should excise tax on fuel be suspended.[18]

The public is given notice of the adjustments to fuel prices with the additional excise taxes on fuel from the TRAIN law. March 2019. Photo by Joseph Purugganan.

If the economic managers were defensive on TRAIN’s impact to inflation, they were offensive when it came to pushing the liberalization of agriculture as a solution to rising prices.

Advance Trade Liberalization

Rice and food (and not gasoline) became the primary target of the government’s inflation-management response. The initial stopgap measures prescribed can be summed up in one word—Importation.

To address the rice price issue, they called for the immediate release of the 4.6-million sacks of rice available in NFA warehouses, and the fast tracking of the approximately 2-million sacks of previously contracted rice. The NFA Council also authorized the importation of a total of 10-million sacks for 2018 and early 2019. The economic managers further recommended the issuance of a directive to further simplify and streamline the licensing procedures for rice imports of the NFA.[19]

Rising fish prices would be addressed by “the issuance of certificates of necessity to allow imports to be distributed in the wet markets in Metro Manila and to the other markets of the country.” Under the existing Fisheries Law,[20] imported fish can only be allowed (outside canning/processing purposes) if the Department of Agriculture (DA), in consultation with the Fisheries and Aquatic Resource Management Council or FARMC, issues a certificate of necessity.

Because there were certain limitations in law, Executive Action was resorted to in order to address the inflation crisis. Duterte issued Administrative Order 13 on September 21, 2018 mandating the removal of non-tariff barriers and streamlining administrative procedures on the importation of agricultural products.

Aside from these immediate measures, the major policy target was the passage of the Rice Tariffication Act, which according to the government, will stabilize food prices and overall inflation as it is “expected to drive down the price of rice by up to 7 pesos per kilo.”

Beyond Rice Tariffication

Rice tariffication has been hounding us since we joined the World Trade Organization (WTO) in 1995. When the Philippines joined the WTO almost 25 years ago, we acceded to this tariff-based trade regime for all of our agricultural products except rice.

The WTO, however, allowed for a temporary respite from the removal of quantitative restrictions for certain products. The Philippines availed of this special treatment provision (Annex 5 of the Agreement on Agriculture) for rice from 1995-2005. The government negotiated and was granted an extension of another seven years (2005-2012), and obtained a final waiver from the WTO General Council that required the Philippines to subject rice to ordinary customs duty no later than 30 June 2017, in accordance with domestic legislative processes.

The special treatment sought for was premised on preparing the sector for eventual removal of the quantitative restrictions in favor of tariffs, as the hitherto allowed form of local protection. Instead, what we saw was how successive governments have continuously failed to support the rice sector and agriculture in general. In Thailand, for example, a major source of our rice imports, public investment in agriculture, forestry and fishery sectors amounted to an average of 3.2-billion USD from 2001-2017, while ours for the same period amounted to a little less than 1.5-billion USD. Thailand is investing more than double in agriculture than what the Philippine government has done for the last 17 years.[21]

While it is true that rice tariffication is an obligation under the WTO, the obligation is limited to the removal of the quantitative restriction and replacing it with a corresponding tariff rate. The WTO did not prescribe a particular rate by which we will then bind our tariff on rice imports.

The proponents of the rice tariffication law, however, used the opportunity presented by the inflation crisis to go beyond what was required under our obligation to the WTO. It is interesting to point out that the bills passed by both the House (HB 7735) and Senate (SB 1998) both focused on the removal of the quantitative restrictions and the creation of a rice competitiveness enhancement fund (RCEF). And yet the final version signed by Duterte—Republic Act 11203—mandates the full liberalization of importation, exportation, and trading of rice aside from the removal of the quantitative restrictions on rice.[22] Duterte had earlier expressed criticism against the WTO and the negative impact it has had on Philippine agriculture as he declared that our country is not ready to meet its obligations under the multilateral body.[23] It seems that he has since changed his tune as he signed the rice tariffication bill into law.

Chaos in the Grains Industry

The new law also repealed the National Grains Industry Development Act that created the National Food Authority (earlier known as the National Grains Authority) and removed the entire section under RA 8178, which defined the regulatory function of the NFA over importation of rice. Current NFA Administrator Tomas Escarez rightly pointed out that with “the removal of NFA’s regulatory functions, which were not explicitly transferred to any other government agency, all grains businessmen will then be free to conduct their business in whatever manner they like, without rules to follow.”[24]

What precipitated this move against the NFA were the issues of mismanagement raised against the NFA amidst a seeming tug-of-war between then NFA Administrator Jason Aquino and the NFA Council led by Duterte’s erstwhile most-trusted lieutenant and former Secretary to the Cabinet Leoncio “Jun” Evasco over the depletion of our country’s rice stocks.

Behind the political intramurals among Duterte’s officials, however, lies the more fundamental issue of the long-term food policy of the administration. The bickering between Aquino and Evasco was not over the question of whether importation should be pushed—but over the mode of importation—with Evasco favoring government to private mode, while Aquino was pushing for the government-to-government mode of importation. Whether inadvertently or deliberate, what was put in question in the NFA debate is whether or not government, through the NFA, should play a part in regulating food importation.

Prelude to privatization

The NFA has long been a target of technocrats pushing to liberalize the rice sector. They have pointed essentially to the monopoly power of the NFA over rice importation, and its implementation of the quantitative restrictions as the agencies main problems.

Other powerful policy influencers like the Asian Development Bank (ADB) have pushed in fact for the privatization of the NFA, with the ADB making this one of the major conditions for the approval of the $175-million Grains Sector Development Program (GSDP) loan.[25]

Winners and Losers

So who stands to gain from the liberalization of the rice industry?

Farmer leader Jimmy Tadeo in a press conference recently said the NFA, the milling industry, and the Filipino rice farmers are the ones that would be hardest hit under the liberalized regime enabled by the new law. According to Tadeo, rice farmers who spend an average of ₱10-14 per kilo would lose out, as the buying price of palay is already at ₱12-15.[26] Rice importation has been sold as a panacea to inflation, but a critical question that has not been answered by the economic managers is what will happen to the price of palay once rice imports come in?

Raul Montemayor of the Federation of Free Farmers painted a grim scenario. According to Montemayor, under the new law, rice tariffs outside ASEAN will be from 40% (within the minimum access volume) to 180% (outside the minimum access volume) but the tariff rate for imports from ASEAN, where we get most of our imports, is pegged at 35%. At 35%, imports of rice (will come in at ₱32 per kilo. The proponents of liberalization will point out that this is an improvement, as the price will drop by ₱8 per kilo from ₱40 to ₱32. What is not being said, however, is that the poorest households who rely on NFA’s ₱27 per kilo rice will be disadvantaged. What will happen to families who use to buy NFA rice and now would have to pay ₱32 per kilo minimum? In reality, the liberalization of the rice trading will not make rice more affordable.[27]

Farmers will be harmed by the low buying price of palay and the downward pressure from the entry of cheaper imported rice, and second, the poorest rice consumers will also be harmed by the absence of low-priced NFA rice in the market.

Those who stand to benefit the most would be the importers and traders who would now have a free hand in importing rice. The NFA has already received 278 applications for out-quota importation of rice[28] (higher than the 180 reported early this year)[29] for a total of around 1.6-million metric tons of rice. On top of the list, applying to bring in 100,000 metric tons of rice, is Purerice Milling and Processing Corporation of Davao businessman and Duterte supporter Jo Soliman, who has also been reported to have bagged a ₱5-billion project for the construction of a large cold storage facility in Benham Rise.[30]

Inflation and the 2019 elections

Inflation rates have indeed gone down since November 2018, and the decline has continued this year as rates went down to 4.4% in January, and to 3.8% in February, the lowest level since February 2018.[31]

Despite declining inflation numbers this year, high commodity prices continue to be an issue of national concern heading into the midterm elections. Several opposition candidates have zeroed in on TRAIN, in particular the excise tax on fuels, as one of the main drivers of rising prices. Senators who voted in favor of TRAIN were put on a defensive, and have been forced to qualify and explain to the public their support for the revenue-generating measure. It appears though that voter preference, at least based on the surveys, has not been affected by these criticisms against TRAIN. Senators seeking re-election who voted in favor of TRAIN—Grace Poe, Cynthia Villar, Nancy Binay, and Sonny Angara—have consistently occupied the top six spots.

But while TRAIN may have been exposed as a possible Achilles heel for some administration senatorial bets, it is important to point out that on solutions to the inflation crisis, the opposition did not offer much of a divergent view. Liberal Party stalwart and 2016 Presidential contender Mar Roxas, who has branded himself as “Mar aming ekonomista” (Mar, our economist) in a letter to Duterte posted on Facebook said “only a massive and immediate additional supply of rice can bring down prices to affordable levels.” He then gave his unsolicited advice to the government to fast track and remove restrictions to importation. In Roxas’ own words, he called on Duterte to “remove the usual bs imposed by NFA so as to allow any and all in the private sector to import rice.” In other words, as far as addressing inflation was concerned, there was a neoliberal consensus from both the administration and opposition.

The groups opposing the rice trade liberalization have launched a junk Cynthia Villar campaign, asking all farmers not to vote for the Senate’s principal author of the new law. The farmers leading the campaign are hoping to rally the support of around 2.4-million rice farmers to make an impact in the coming elections. It would be a tough campaign though as Villar continues to occupy the second spot in the surveys and her numbers are moving up fast.

If the election results mirror the latest surveys, then we can expect Congress to push even harder for economic policies that support Duterte’s agenda.

Long-term implications

There is very little discussion among the candidates on the possible long-term implications of the Duterte administration’s response to the inflation crisis.

Rather than pushing importation as a temporary and emergency response to ease the supply issues that are driving prices up, it has become the de facto policy. The full liberalization of the rice industry is a major concern of farmers and groups advocating food sovereignty. Pushing full liberalization, at the same time as a withdrawal of State’s responsibility to regulate imports, will create a new crisis in the rice sector. The livelihoods of rice farmers would be imperiled, the poorest rice consumers would lose access to cheaper rice, and our dependence on food imports would increase considerably. As the economic viability of domestic rice production decreases, there will also be increased pressure to convert erstwhile rice lands for production of other more viable cash crops for exports, and to other non-agricultural uses.

There are similar concerns for fisheries, another of our country’s major food sources. The group Oceana said in a statement that “short-term imports may actually put long-term food security and fisherfolk at risk.” The group asserted: “issues haunting fisheries management can only be solved through a more comprehensive and participatory plan.”[32]

The Duterte administration may have successfully weathered the inflation crisis and a major challenge to its economic program, but in so doing it has revealed further its neoliberal character and may have set us further back from the path to more inclusive development.#

______________

[1] Ranada,P. Inside Story: How Duterte decided on Boracay closure. Rappler. 12 April 2018. Online publication. https://www.rappler.com/newsbreak/in-depth/200075-duterte-decision-boracay-closure

[2]David, R. The way Duterte governs: Inquirer columnist. The Straits Times. 24 April 2018. Online publication. https://www.straitstimes.com/asia/se-asia/the-way-duterte-governs-inquirer-columnist

[3] Cu, R. Dominguez: Tax reform, BBB, to produce a revolution in Philippine economic development. BusinessMirror. 5 July 2018. Online publication.https://businessmirror.com.ph/2018/07/05/dominguez-tax-reform-bbb-to-produce-a-revolution-in-philippine-economic-development/

[4] Republic Act 10963 otherwise known as The Tax Reform for Acceleration and Inclusion (TRAIN) Act. https://www.thecorpusjuris.com/legislative/republic-acts/ra-no-10963.php

[5] Post by DOF Reform in the Department of Finance website. 1 August 2018. Accessed online at http://www.dof.gov.ph/taxreform/index.php/2018/08/01/trains-p181-b-revenues-help-raise-p3-2-t-2019/

[6] Pulse Asia. September 2018 Nationwide Survey on Urgent National Concerns and the Performance Ratings of the National Administration on Selected Issues. September 2018. Accessed online at http://www.pulseasia.ph/september-2018-nationwide-survey-on-urgent-national-concerns-and-the-performance-ratings-of-the-national-administration-on-selected-issues/

[7] ibid

[8] Department of Energy news.DOE expects new excise tax to reflect on fuel prices by mid-January. 1 January 2019. Accessed online at https://www.doe.gov.ph/energist/doe-expects-new-excise-tax-reflect-fuel-prices-mid-january

[9] Rey, A. Malacañang approves suspension of fuel excise tax increase in 2019.Rappler. 14 November 2018. Online publication. https://www.rappler.com/nation/216653-diokno-says-malacanang-approves-fuel-excise-tax-hike-suspension

[10] Department of Finance figures as cited by Secretary Leonor Briones of Department of Education. Affirming the Importance of the Tax Reform for Acceleration and Inclusion (TRAIN). Department of Education website. 25 July 2018. Accessed online at http://www.deped.gov.ph/affirming-the-importance-of-the-tax-reform-for-acceleration-and-inclusion-train/

[11] Mapa, D. The Effect of Diesel Excise Tax on Inflation and Poverty – BSP. University of the Philippines School of Statistics. Powerpoint presentation acced online at www.bsp.gov.ph/events/pcls/downloads/2017/BSP_3b_mapa_presentation.pdf

[12] Bangko Sentral ng Pilipinas Media Release. Government Keeps Inflation Target at 3 Percent + 1 Percentage Point for 2018 – 2020. 28 December 2017. Accessed online at http://www.bsp.gov.ph/publications/media.asp?id=4570&yr=2017

[13] NEDA-DBM-DOF Joint Statement On The May 2018 Inflation Report. 5 June 2018. Accessed online at

[14] NEDA-DBM-DOF Joint Statement on the September 2018 Inflation report. 5 October 2018. Accessed online at https://www.dof.gov.ph/taxreform/index.php/2018/10/05/joint-statement-september-2018-inflation-economic-team-dof-neda-dbm/

[15] Philippine Statistics Authority. Rice and Corn Situation and Outlook Reports. 13 November 2018. Accessed online at https://psa.gov.ph/content/rice-and-corn-situation-and-outlook-reports

[16] Royandoyan, O. Opinion piece. Beyond Rice Tariffication. 10 October 2018. Abs-cbn news blog. Accessed at https://news.abs-cbn.com/blogs/opinions/10/10/18/opinion-beyond-rice-tarrification

[17] Balinbin, A with Saulon, V. It’s a go for fuel excise tax hike. 5 December 2018. Accessed online at https://www.bworldonline.com/its-a-go-for-fuel-excise-tax-hike/

[18] ibid

[19] ibid

[20] Amended Fisheries Code of the Philippines (RA 10654)

[21] Food and Agriculture Organization of the United Nations. FAO stats. Accessed online at http://www.fao.org/faostat/en/#country

[22] Republic Act 11203, An Act Liberalizing the importation, exportation and trading of rice, lifting for the purpose the quantitative import restriction on rice, and for other purposes.

[23] Guinto, J. ‘Commodity problem’ grips Philippines, Duterte says. Abs-cbn News online. 5 June 2016. Accessed online at https://news.abs-cbn.com/business/06/04/16/commodity-problem-grips-philippines-duterte-says

[24] National Food Authority Statement on the Rice Tariffication. Accessed online at http://nfa.gov.ph/35-news/1478-nfa-not-against-rice-tariffication

[25] Philippine Star new report. Gov’t, ADB mull new option on NFA sale . Philippine Star. Accessed online at https://www.philstar.com/business/2000/03/10/101027/govt-adb-mull-new-option-nfa-sale#jrbvmxhhGWToc3xQ.99

[26] Notes from the Press Conference on the Rice Tariffication Law jointly organized by national farmers federations, civil society organizations and food sovereignty advocates opposing the Rice Tariffication Law. 5 March 2019

[27] ibid

[28] National Food Authority Rice importation program. List of Applicants under the NFA Out-Quota Rice Importation Program by the Private Sector of Omnibus Origin. Accessed online at http://nfa.gov.ph/programs-projects/others/rice-importation

[29] Ignacio, R. Traders to import 1.19M MT of rice. BusinessWorld Online. 23 January 2019. Accessed online at https://www.bworldonline.com/traders-to-import-1-19m-mt-of-rice/

[30] Pascual, F. Davao capitalists ride high nowadays. Philippine Star. 21 January 2018. Accessed online at https://www.philstar.com/opinion/2018/01/21/1779857/davao-capitalists-ride-high-nowadays

[31] Philippine Statistic Authority. Summary Inflation Report Consumer Price Index (2012=100): March 2019. 15 April 2019. Accessed online at https://psa.gov.ph/price-indices/cpi-ir

[32] Oceana Philippines Statement on fish importation. GMA News online. 25 January 2019.Accessed https://www.gmanetwork.com/news/money/economy/682811/oceana-philippines-fish-importation-policy-may-hurt-fisherfolk/story